For many years, people have regarded gold as a sign of opulence and accomplishment. They have used it as money, a store of value, and to create crafts like jewellery and statues. The value of the poiund was even directly linked to gold until Britain stopped using the gold standard in 1931.

In this guide, you will find out how to invest in gold and why so many investors love it.

Why Should You Invest in Gold?

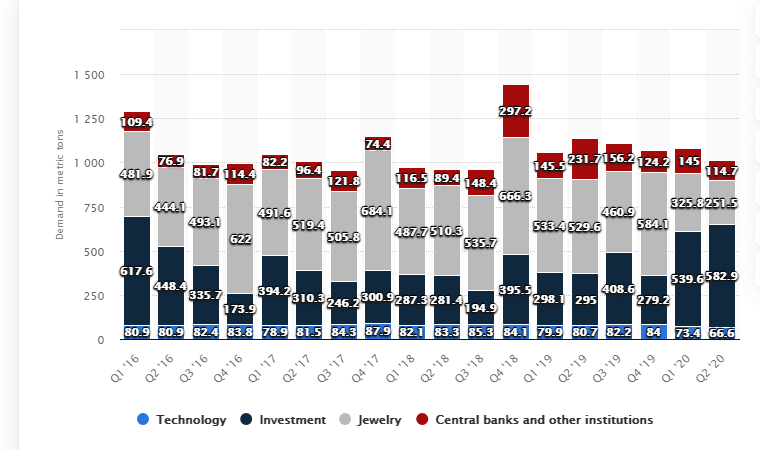

According to data from Statista, the global demand for gold for investment uses was the highest in the first half of 2020. People used more gold in investment than in technology, jewellery, and as a reserve.

The adverse global economic effects resulting from the coronavirus pandemic response could have caused the high demand for gold for investment purposes.

During tough economic times, gold acts as a safe-haven asset.

As more people move their wealth to safety, the price of gold increases. Gold is a safe-haven asset because it has maintained its purchasing power for thousands of years. As a result, it is considered well-suited to protect people’s wealth during a crisis.

Other reasons why so many investors love gold include:

- It is scarce. Since it is in limited supply, its demand remains high, therefore driving its price. Also, the increasing demand for gold in countries where the middle-class is growing has boosted the price.

- When inflation increases, investors typically use gold as a store of value.

- You can use it to diversify your investment portfolio. The reason for this is that when the stock market is performing well, gold tends to underperform. But when stocks struggle, gold typically does well. Hence, gold acts as an excellent diversification asset.

- Fiat currencies like the pound tend to drop in value against gold over time.

Some experts believe that you should put about five to ten percent of your investment portfolio into gold. However, you can increase or decrease this percentage based on your financial situation and risk tolerance.

How to Invest in Gold

Investing in gold does not begin and end with purchasing physical gold bars. There are various other ways to invest in this precious metal. Some of these methods, for example, track the price of gold and offer indirect exposure to the gold market.

Examples of gold investments include:

- Gold stocks

- Gold funds

- Gold futures contracts

- Gold options contracts

- Gold jewellery

- Gold coins

- Gold bars

Also, some countries hold part of their wealth in gold reserves. For example, the UK still holds gold reserves even after abandoning the gold standard in 1931. The country stores its gold reserves at the Bank of England.

Below, you will learn how to invest in gold through the purchase of gold stocks, gold bars, and gold funds.

How to Buy Gold Stocks

Gold stocks are the shares of companies involved in gold mining, exploration, and distribution.

Anyone can buy gold stocks but they tend to be volatile. Since the mining business is complex, and many factors are at play, gold stocks might not increase when the price of gold is rising. Therefore, consider the risk of gold stocks before you invest in them.

Some of the gold stocks listed on the London Stock Exchange (LSE) are Polymetal International, Centamin, and SolGold.

To invest in gold stocks, follow these steps:

- Research gold mining companies listed on the LSE and choose the one(s) you like.

- Create an account with an online broker.

- Got to the shares section and select the company of your interest.

- Next, place a buy order with the amount you want to invest in that stock.

- Once the order is filled, you are an investor in a gold stock and have indirect investment exposure to gold.

While gold shares provide indirect exposure to gold and direct exposure to the performance of the gold mining industry, gold shares are also correlated to the overall stock market. That means they may not act as well as diversification assets than a gold tracker ETF, for example.

How to Buy Gold Bars

You can purchase gold bars or coins from reputable gold dealers in your local area. Alternatively, you can buy also buy gold bullions from online vendors.

If you want to store the gold yourself after buying it online, you should consider the shipping costs. However, international gold dealers provide vault storage if this is an option you would like to pursue.

To buy gold bars, follow this process:

- Look for reputable gold dealers.

- Check for reviews online to find the best dealer. Also, compare the prices the different dealers are offering and pick the best price.

- When buying gold bars, check their authenticity by ensuring that they have the name of the manufacturer, the purity level, and the weight. Before buying gold bars, ask the dealer to weigh them.

- After making the purchase, go straight home and store the bars in a safe

While buying from a local gold dealer is convenient, the price is usually higher than the market price. That said, buying gold bars online requires some level of caution.

How to Buy Gold Funds

There are two types of gold funds that you can purchase: gold ETFs and gold mutual funds. These are popular investment options for private investors.

Gold ETFs

Gold exchange-traded funds (ETFs) offer investors exposure to the price movements of gold. Investment managers that offer Gold ETFs buy and store gold on behalf of the investors and trade them on exchanges. Examples of gold ETFs are SPDR Gold Trust and Sprott Gold Miners ETF.

To buy gold ETFs, use this process:

- Research the best gold ETFs

- Open an account with an online brokerage company

- Go to ETFs and choose an ETF like SPDR Gold Trust

- Place a buy order with the amount of your choice

If you want the convenience of not having to store physical gold or searching for a reputable gold dealer, gold ETFs are arguably the best option. Moreover, the cost of buying gold ETFs is lower than that of physical gold.

Gold Mutual Funds

You can also invest in gold mutual funds. Gold mutual funds typically invest in shares of gold mining companies on behalf of their investors.

The difference between gold ETFs and gold mutual funds is that the former fluctuates with the value of gold while the latter fluctuates with the market and company value.

Examples of mutual funds include Fidelity Select Gold Portfolio and First Eagle Gold Fund. To invest in gold mutual funds, use the same steps that you would to buy ETFs.

Whichever gold investment option you choose eventually, you should always conduct a thorough research first. If you need help, consult with a financial advisor to better understand how each option works.