A good credit score is crucial because it is a representation of your financial health. However, is it enough to help you access good deals and a wide range of loan products? Probably not.

In this guide, you will learn about the Credit Club and how it can help you improve your creditworthiness.

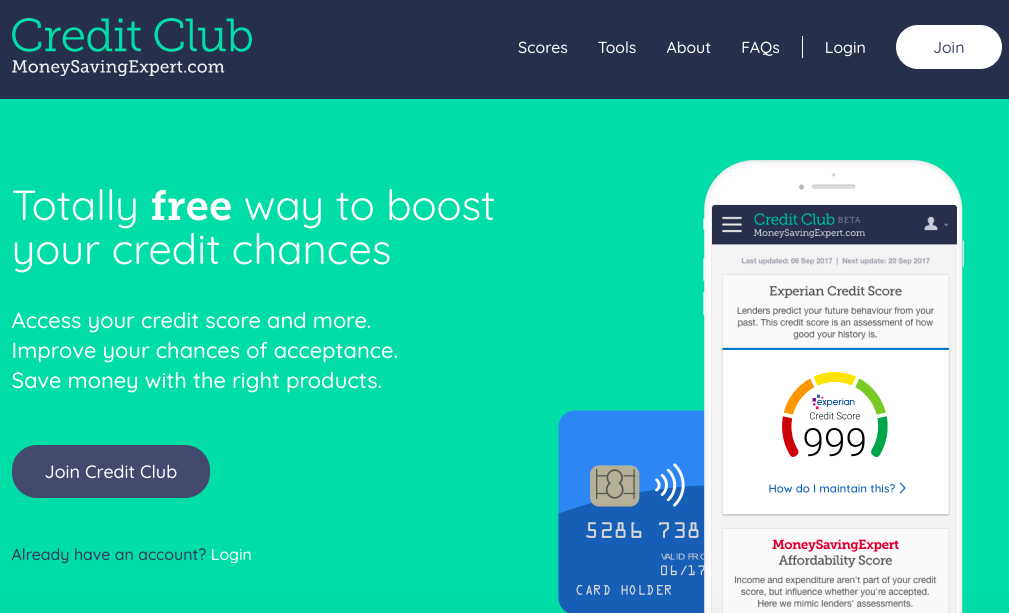

What is the Credit Club?

The Credit Club is a free tool that allows users to receive an Experian Credit Score, a unique Affordability Score, and a Credit Hit Rate.

The Credit Club is a service provided by Money Saving Expert.

Furthermore, the Credit Club offers a calculator to review your loan and credit card eligibility. It also gives you information about the strength of your credit profile and how you can improve it.

How to Register for Credit Club?

To access the Credit Club, you need to sign up for an account on Money Saving Expert.

The platform will ask for details about your financial situation and your family circumstances. This will help it to examine your affordability against your credit score.

Next, the platform will verify that you have provided the correct information. Moreover, it will confirm that it is giving you the accurate credit information. Part of the verification process includes directing you to Experian to receive your credit score. Money Saving Expert has partnered with Experian to issue users with credit scores.

You must have lived in the UK for six years or more for the platform to find your credit report. However, if you have not lived in the UK for that long, Money Saving Expert might still manage to match you with a credit record depending on the number of home addresses you have had. Some of these instances include:

- If you have lived at two or more addresses and have held a bank account during that time.

- If you have been at the electoral roll while living at both addresses.

Note that Money Saving Expert gets its addresses from the Royal Mail Postcode Address File. Therefore, if your address is not on this list, you can contact Royal Mail to add it. Thereafter, you can register for Credit Club easily.

How Does It Work?

Money Saving Expert has collaborated with several companies to issue its users with different scores.

For instance, it has partnered with Experian, which offers credit scores and reports. The platform also works with HD Decisions, a company that calculates eligibility scores.

Credit Club is free. But how does the Money Saving Expert afford to offer this service?

When you apply for any of the financial products that the platform has given you an eligibility score for and get accepted, then the provider pays Money Saving Expert.

Your Credit Club Dashboard

Your Credit Club dashboard displays the following details.

- Experian Credit Report: Your credit report highlights information like your credit history, recent applications, and credit payments. Lenders use this information to examine your creditworthiness.

- Experian Credit Score: This score is based on the details in your credit report. It helps lenders to determine if you are a good risk or not.

- Credit Hit Rate: The Money Saving Expert Credit Hit Rate indicates your chances of getting loan products. It also shows you which lenders are likely to give you a product.

- Credit cards and loans eligibility calculator: This calculator shows you your eligibility, product by product.

- Affordability: This information tells you which products you can afford to borrow. The platform uses the income and expenditure details that you provide to indicate your affordability for loans and credit cards.

- Credit profile insights: The Platform offers insights about the barriers that affect your credit eligibility and how you can improve them.

How Can It Help You?

Joining the Credit Club is helpful in the following ways.

- You can protect your credit score because the platform will show you your chance of getting a deal before applying.

- The platform offers insights on how to improve your ability to receive credit.

- Money Saving Expert lets you know if you can afford a product by analysing your income, debt exposure, and expenditure. The platform gives you affordability scores for credit cards and loans.

- You will get a credit report, allowing lenders to assess all your credit history from one place.

- Through Credit Club, you can access Wallet Workout, a chatbot tool. The tool helps you to figure out which credit products could save you money by asking you some questions.

- If you have debt problems, you can use the Money Saving Expert debt plan.

Credit Club provides one dashboard to manage all your credit matters, allowing you to lead a healthier financial life. Check it out if you want help managing your credit matters.